The Financial Planning Process

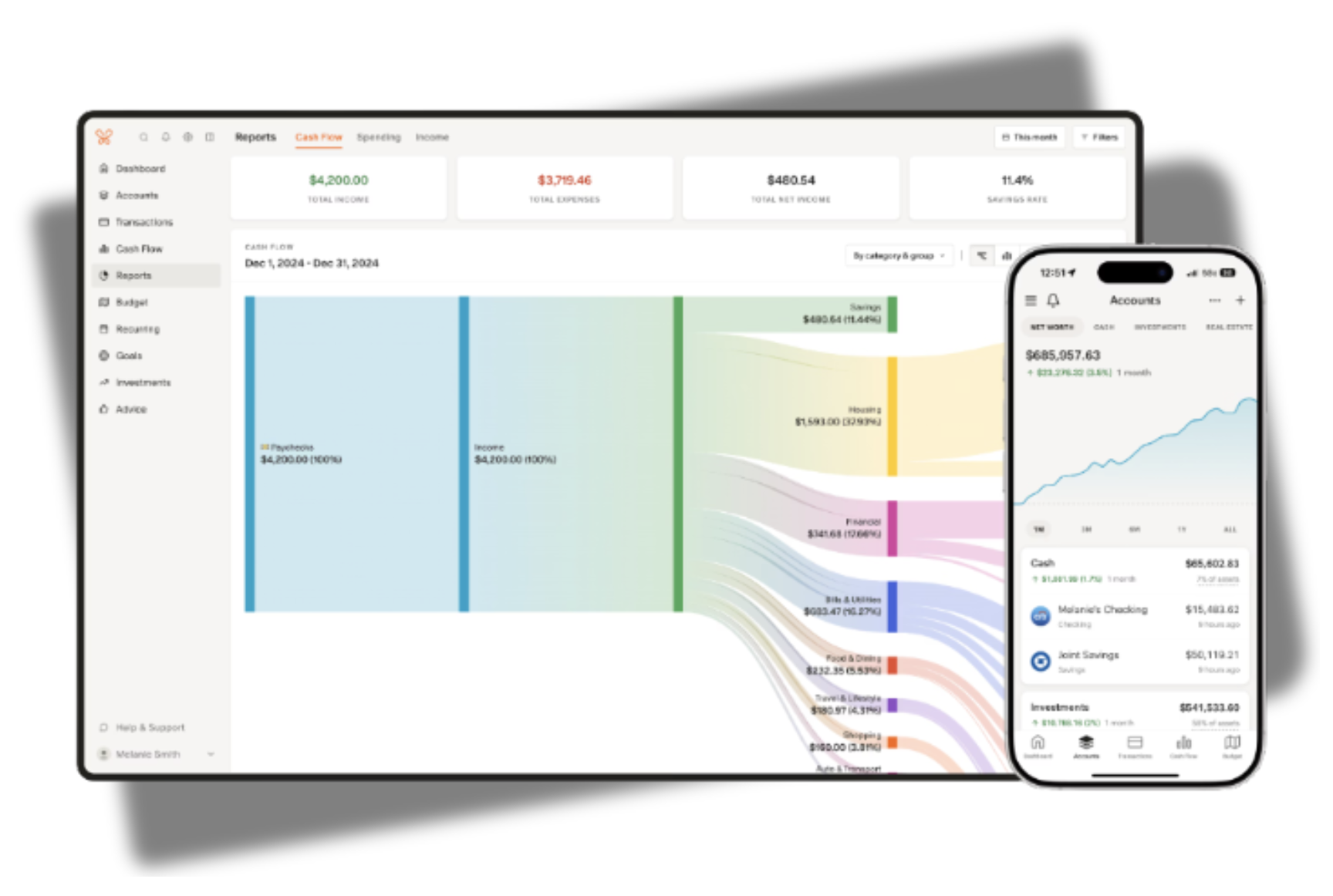

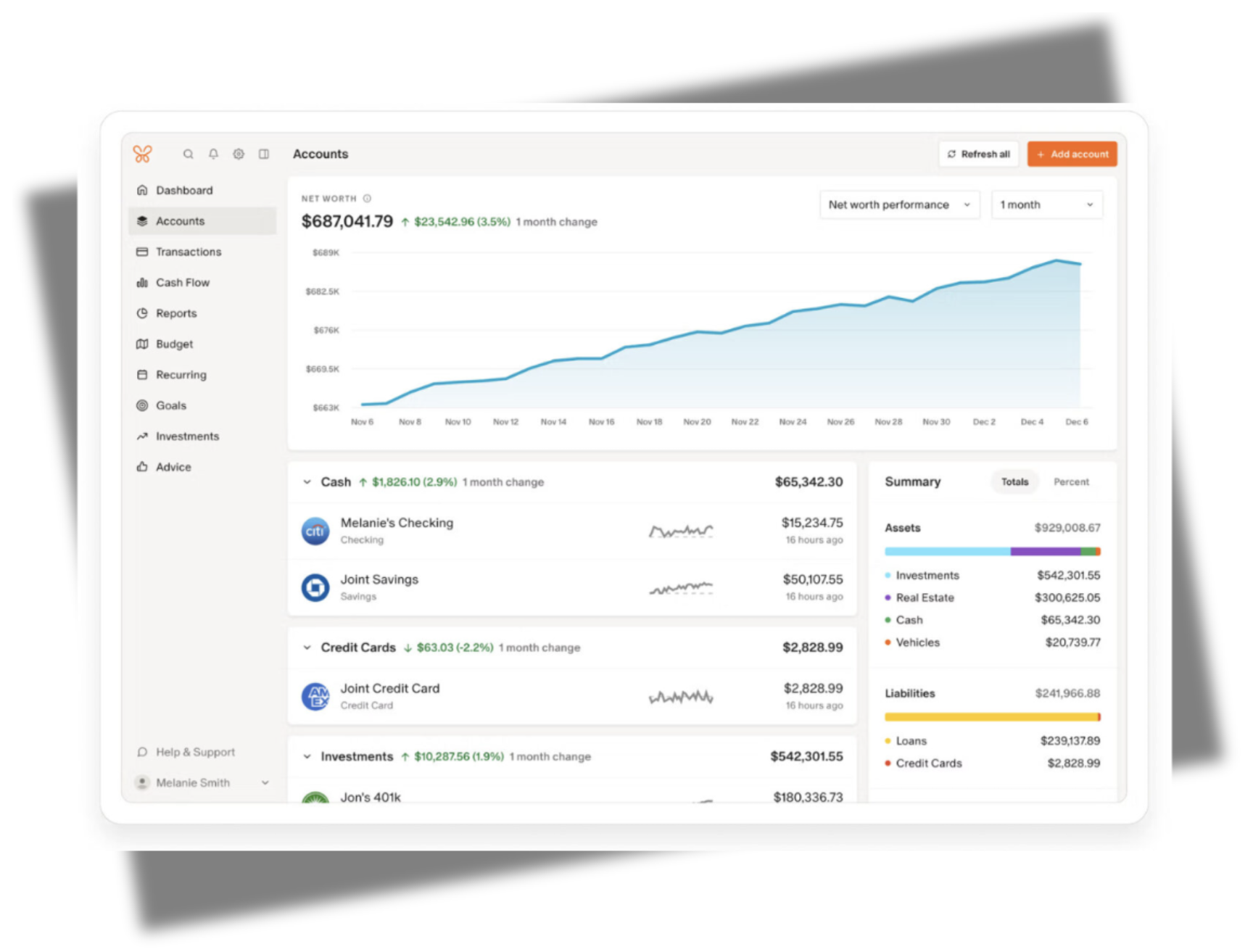

My financial planning process helps military veteran and retiree families work through their most important decisions from the first consultation to long-term plan implementation. This process illustrates how I gather your information, build a comprehensive plan, and support you through each step with fiduciary, flat-fee guidance.

Consultation

Start Your Planning Journey

I get it. Choosing someone from the internet to talk about your finances can feel a little strange.

That’s why this first call is all about you. We’ll talk about what brought you here, what you’re looking for in a financial advisor, and what’s most important to you right now.

I’ll also give you space to ask any questions you have about the firm, how I work, or what to expect.

What I won’t do is pressure you to make a decision on the spot. This is an important relationship and I want you to take the time you need to think it through. I’ll take a few days before reaching out to schedule a “Cleared to Proceed” meeting if that’s what you’re looking for.

Optional Pre-Engagement Plan

Still unsure if financial planning is right for you? Give it a try!

This is an optional, 30-minute presentation of a 1st year gameplan, focused on solving your pain points and creating efficiencies in your finances to achieve your goals.

There are no commitments expected from this meeting. It serves as a decision-making tool for you to get to know me more and test both the tangible and intangible benefits of hiring a “financial advicer”.

Onboarding

Getting Organized Meeting

This is an important meeting, but there’s no need to stress.

We'll begin by refining your values and goals; a continuous, but important process as they’re the foundation of your financial plan and guide everything we do together.

From there, we’ll take a deep dive into your full financial picture: accounts, insurance policies, tax returns, estate documents, family dynamics, cash flow, savings, retirement plans, and more.

And don’t worry if you don’t have all the documents handy or aren’t sure where to start. I’m here to walk through it with you, step by step.

Strategic Vision Meeting

This meeting is where you get to dream.

If we haven’t framed some initial values and goals yet, we’ll continue to refine them. We’ll also start crafting your Statement of Financial Purpose; your “why” behind the plan.

If there is any other information that I need to build your plan, we’ll talk about it here. as we work towards clarity, not perfection.

Plan Review & Implementation Meeting

Sit back and take in the initial plan and recommendations.

I’ll start with a picture of where you are today. Then I’ll move into where you want to be, based on the values, goals, and your Statement of Financial Purpose. Then, I’ll lay out the recommended steps to get there, naming just a few of them to start with first. I walk with you throughout the entire implementation process to keep you motivated toward achieving your goals!

Then Live A Life of Purpose, Meaning, and Fulfillment

Planning Cycle - Your Ongoing Process

1st Quarter

Annual Goal Updates

Cash Flow Updates

Organize & Prepare for Tax Return

Review Retirement Projections

Update Retirement Account Contributions

Business Estimated Payments

2nd Quarter

Confirm Tax Filing

Investment Allocation Review

Current Year Tax Projection & Strategy

Business Estimated Payments

3rd Quarter

Beneficiary Designation Review

Review and Update Estate Documents

Mid-Year Goals & Cash Flow Check

Review 529 Plans

Review All Active Insurance Policies

Business Estimated Payments

4th Quarter

Review Risk Tolerance Allocation

Capital Gains Planning

Reassess Tax Projection & Adjust

Open Enrollment Healthcare Planning

Business Estimated Payments

Charitable Giving Planning

Roth Conversion Planning

QCD Planning

Call When Life Happens

Read the FWM Data Security and Privacy Policy Here