Military & Retiree Financial Planning Services

Ongoing Wealth Management

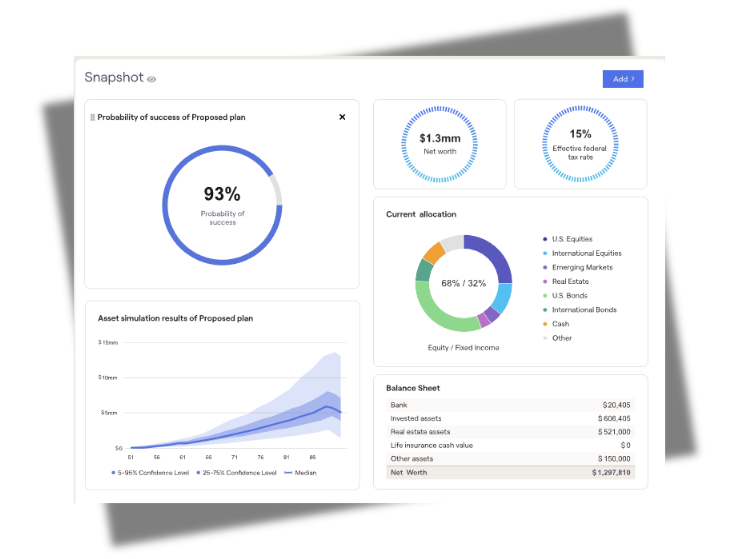

Life is constantly changing, and your financial plan should evolve with it. Our Ongoing Wealth Management service provides continuous, fiduciary guidance for military retirees and families who want long-term support and professional investment oversight.

At the core of this service is ongoing investment management, coordinated with the rest of your financial life. We actively manage individual investment accounts while aligning cash flow, retirement income, taxes, and risk management into a cohesive strategy designed to adapt as life changes.

This service includes guidance across:

Investment management and portfolio oversight

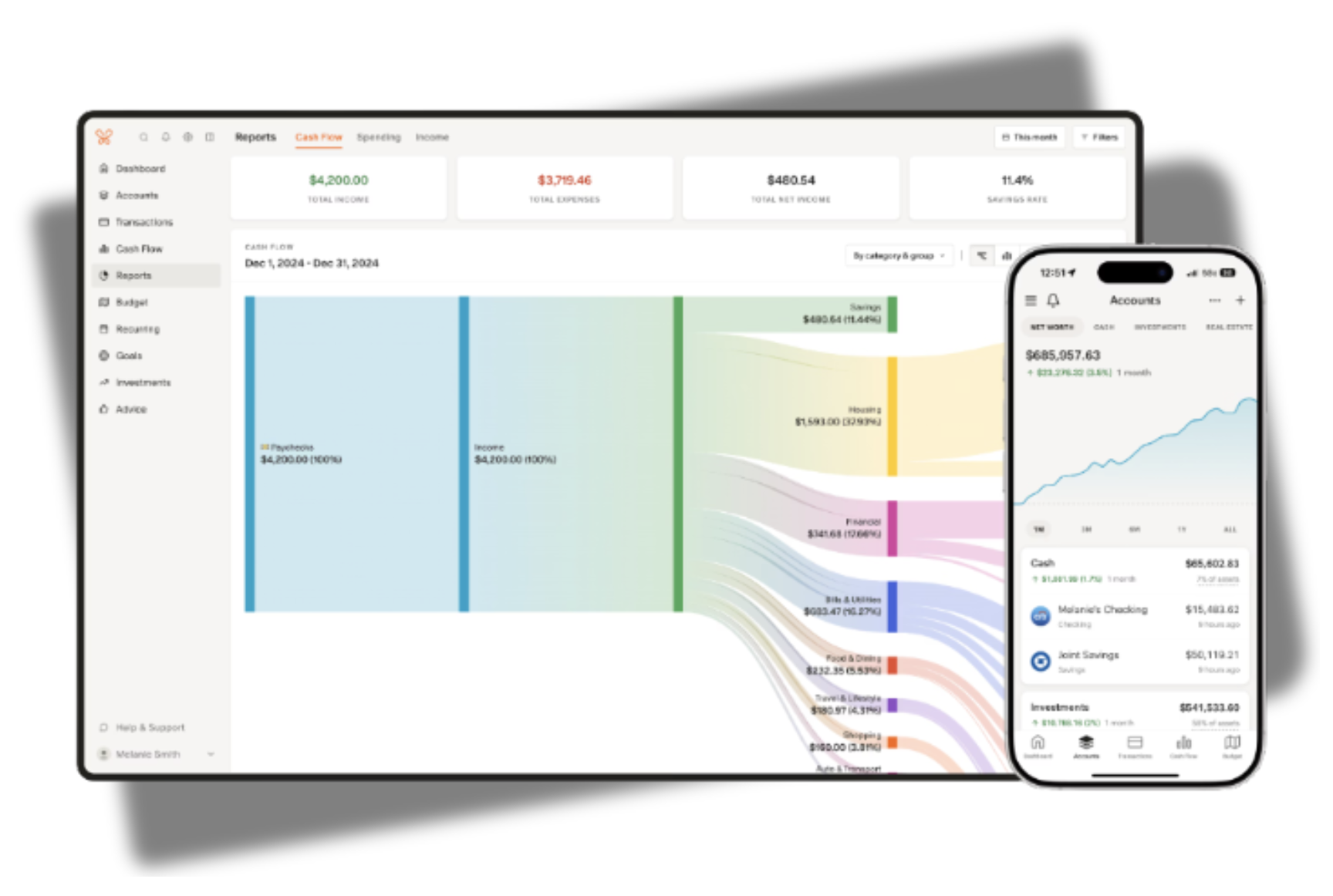

Cash flow and savings strategy

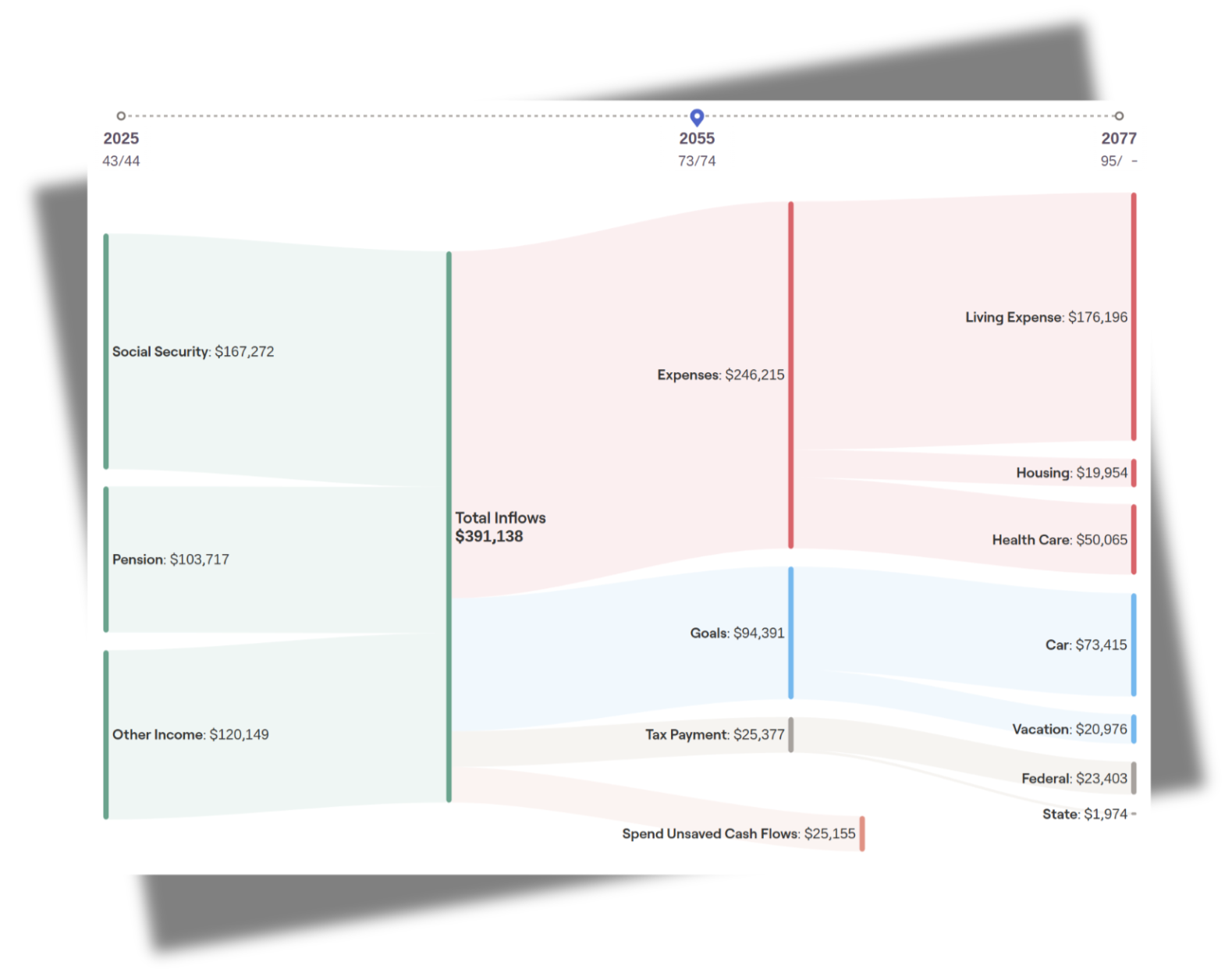

Retirement income planning

Tax-aware planning decisions

Estate planning coordination

Insurance and risk assessment

Education planning, when applicable

You will receive personalized recommendations, regular check-ins, and ongoing support to help you stay aligned with your goals as circumstances evolve.

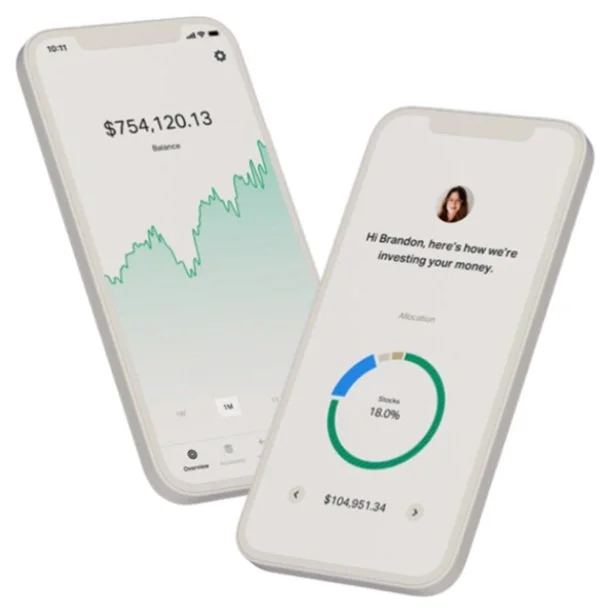

Ongoing Comprehensive Financial Planning

This service is designed for military families who prefer to manage their own investments but want professional, ongoing guidance across their full financial picture.

Ongoing Comprehensive Financial Planning provides the same level of fiduciary advice and coordination found in our Wealth Management service, without discretionary investment management of individual accounts. We help you make informed decisions, reduce blind spots, and stay aligned with your goals while you retain control of day-to-day investment execution.

This service includes guidance across:

Cash flow and savings strategy

Retirement planning and benefit coordination

Tax-aware planning decisions

Estate planning coordination

Insurance and risk assessment

Investment risk assessment and portfolio allocation guidance

Asset location and tax allocation recommendations

You will receive personalized recommendations, regular check-ins, and ongoing support to help you navigate financial decisions with clarity and confidence.

Priced For Your Stage in Life

Our ongoing services are priced based on the complexity of your financial situation, not the size of your investment accounts. This approach helps keep fees transparent, reasonable, and aligned with the level of planning required.

Base Pricing by Client

Active Duty Military

Tailored pricing for those currently serving, reflecting military pay structures, benefits, and transition considerations.

Veteran or Retired Military and Federal or State Government Employees

Designed for individuals and families with multiple income sources, pensions, or government benefits that require coordinated planning.

Non-Military and Non-Federal Government Employees

Built for professionals, families, and business owners with unique compensation structures and financial considerations.

How Complexity Affects Pricing

To keep fees as low as possible, base pricing assumes a lower level of financial complexity. Some planning situations require additional time, coordination, and expertise. When present, these factors may increase the overall fee.

Common complexity factors include:

Special needs planning

Blended family dynamics

Business ownership

Taxable investment accounts over $100,000

Equity-based compensation such as ISOs, RSUs, or ESOPs

Student loan balances over $75,000

Being within ten years of required minimum distribution age

Income-producing real estate properties

Your actual fee is determined by how these factors apply to your specific situation.

Project-Based Financial Planning

One-time assessments tailored to your needs

Project-based financial planning is designed for individuals and families who want professional guidance on a specific financial question or decision. This option is ideal when you need a focused assessment without an ongoing advisory relationship.

During a project, we typically address one to three areas of comprehensive financial planning, depending on your goals and circumstances. Common project areas include:

Cash flow and budgeting

Education planning

Tax planning

Retirement planning

Estate planning

Investment risk assessment

Insurance risk assessment

A brief discovery meeting is required to understand your needs, confirm scope, and provide a personalized cost estimate.

Simple, Transparent, Flat-Fee Pricing

Our ongoing services are provided on a flat-fee, fee-only basis. Your fee is based on the complexity of your financial situation, not the size of your investment accounts.

Fee-only

No commissions, product sales, or referral fees.

Flat-fee

No percentage-based investment management charges.

Use the calculator below to estimate your fee based on your circumstances.